(Amendment No. )

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material §240.14a-12 | |||

| ☒ | No fee | |||

| ||||

| ||||

| ||||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | 14a-6(i)(1) and | |||

| ||||

| ||||

| ||||

| ||||

0-11. | ||||

621 NW 53rd Street, Suite 7004955 Technology Way

Boca Raton, Florida 3348733431

Telephone: (561)893-0101

March 13, 201822, 2024

Dear Shareholder:

You are cordially invited to attend the 20182024 annual meeting of the shareholders of The GEO Group, Inc. We will hold the meeting virtually, conducted via live audio webcast at www.virtualshareholdermeeting.com/GEO2024 on Tuesday, April 24, 2018,Friday, May 3, 2024, at 9:10:00 a.m.A.M. (EDT).

This year we are furnishing proxy materials to our shareholders primarily on the Internet rather than mailing paper copies of the materials to each shareholder. As a result, most of you will receive a Notice of Internet Availability of Proxy Materials instead of paper copies of this proxy statement and our annual report. The notice contains instructions on how to access the proxy statement and the annual report over the Internet, as well as instructions on how to request a paper copy of our proxy materials. This process will significantly lowerlowers the costs of printing and distributing our proxy materials. On or about March 13, 2018,22, 2024, we mailed to shareholders a Notice of Internet Availability of Proxy Materials.

Your vote is very important to us. Whether or not you plan to attend the meeting virtually, your shares should be represented and voted. After reading the enclosed proxy statement, please vote your shares as soon as possible. Shareholders may vote via the Internet at www.virtualshareholdermeeting.com/GEO2018,GEO2024, by telephone, or by completing and returning a proxy card. Submitting a vote before the annual meeting will not preclude you from voting virtually at the meeting should you decide to attend. If you wish to participate in the meeting, please refer to page 57pages 74 for additional guidelines.

Sincerely,

George C. Zoley

Chairman of the Board,

Chief Executive Officer and FounderChairman

621 NW 53rd Street, Suite 7004955 Technology Way

Boca Raton, Florida 3348733431

Telephone: (561)893-0101

Notice of Annual Meeting of Shareholders on April 24, 2018May 3, 2024

March 13, 201822, 2024

The annual meeting of the shareholders of The GEO Group, Inc. will be held on Tuesday, April 24, 2018,Friday, May 3, 2024, at 9:10:00 a.m.A.M. (EDT). The meeting will be held virtually, conducted via live audio webcast at www.virtualshareholdermeeting.com/GEO2024 for the purpose of considering and acting on the following proposals:

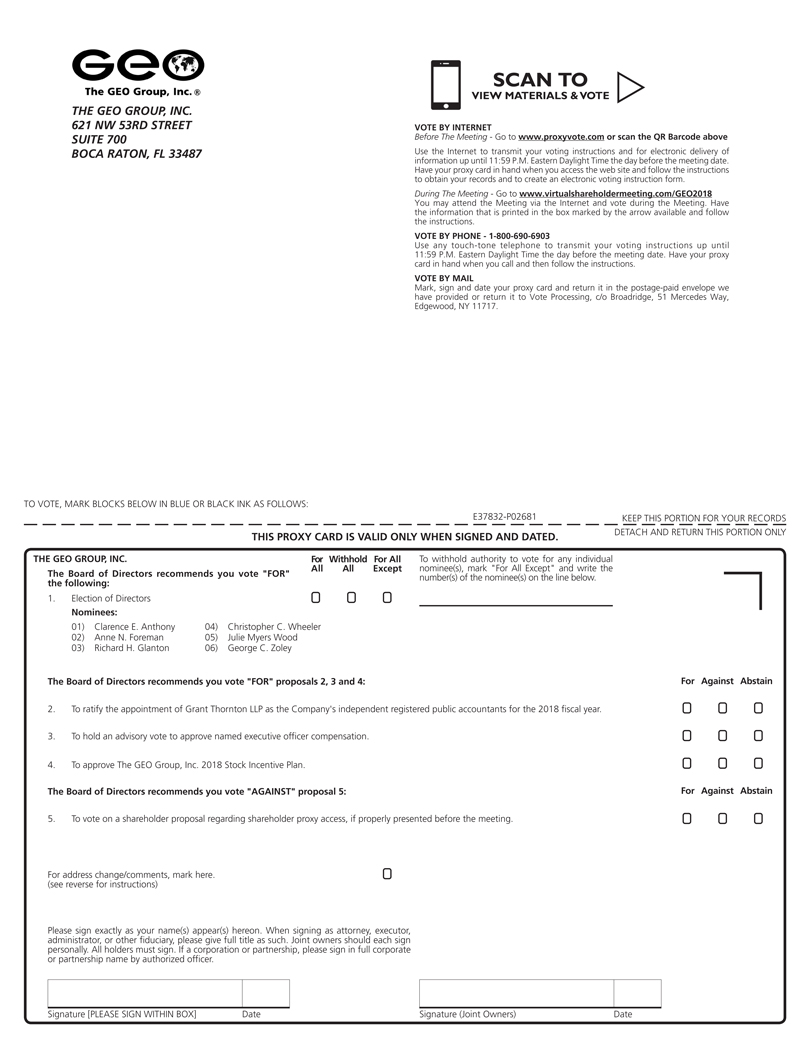

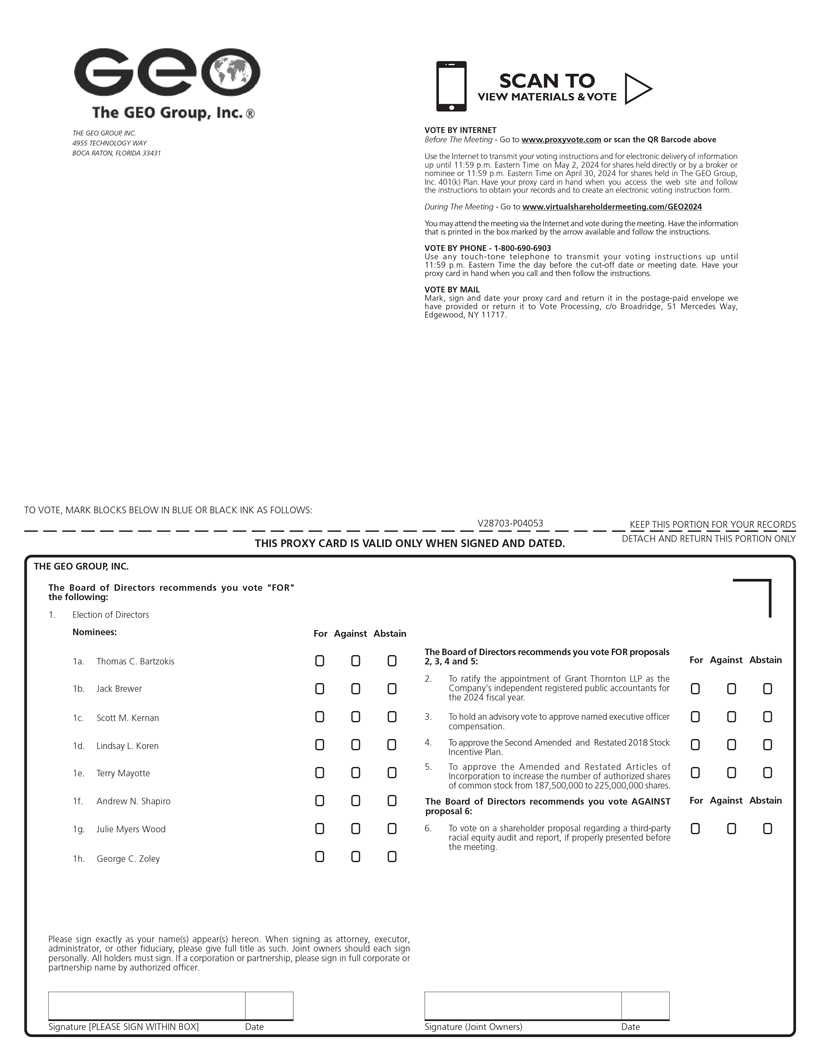

| (1) | To elect |

| (2) | To ratify the appointment of Grant Thornton LLP as our independent registered public accountants for the fiscal year |

| (3) | To hold an advisory vote to approve named executive officer compensation; |

| (4) | To approve |

| (5) | To approve the Amended and Restated Articles of Incorporation to increase the number of authorized shares of our common stock from 187,500,000 to 225,000,000 shares; and |

| (6) | To vote on the shareholder proposal set forth in the proxy statement, if properly presented before the meeting. |

Only shareholders of GEO’s common stock of record at the close of business on February 27, 2018,March 11, 2024, the record date and time fixed by the boardBoard of directors,Directors, are entitled to notice of and to vote at the annual meeting. Additional information regarding the proposals to be acted upon at the annual meeting can be found in the accompanying proxy statement.proxy.

The Securities and Exchange Commission (“SEC”) has adopted a “Notice and Access” rule that allows companies to deliver a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) to shareholders in lieu of a paper copy of the proxy statement and related materials and the Company’s Annual Report to Shareholders (the “Proxy Materials”). The Notice of Internet Availability provides instructions as to how shareholders can access the Proxy Materials online, contains a listing of matters to be considered at the meeting, and sets forth instructions as to how shares can be voted. Shares must be voted either by telephone, online or by completing and returning a proxy card. Shares cannot be voted by marking, writing on and/or returning the Notice of Internet Availability. Any Notices of Internet Availability that are returned will not be counted as votes. Instructions for requesting a paper copy of the Proxy Materials are also set forth on the Notice of Internet Availability.

By Order of the Board of Directors,

John J. BulfinJoe Negron

Senior Vice President, Legal Services, General Counsel

and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON TUESDAY, APRIL 24, 2018.FRIDAY, MAY 3, 2024.

GEO’s proxy statement and annual report are available online at: www.proxyvote.com

i

THE GEO GROUP, INC.

621 NW 53rd Street, Suite 7004955 Technology Way

Boca Raton, Florida 3348733431

Telephone: (561)893-0101

March 13, 201822, 2024

The GEO Group, Inc. (“GEO,” the “Company,” “we” or “us”) is furnishing this proxy statement in connection with the solicitation of proxies by our board of directors (the “Board of Directors” or “Board”) for use at the annual meeting of shareholders on April 24, 2018,May 3, 2024, at 9:10:00 a.m.A.M., Eastern Daylight Time. This year’s annual meeting will be a virtual meeting of shareholders, conducted via live audio webcast. You will be able to attend the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting via a live audio webcast by visiting www.virtualshareholdermeeting.com/GEO2018.GEO2024. Please note that the proxy card provides a means to withhold authority to vote for any individual director nominee. Also note that the format of the proxy card provides an opportunity to specify your choice between approval, disapproval or abstention with respect to any individual director nominee and the proposals indicated on the proxy card. A proxy card which is properly executed, returned and not revoked will be voted in accordance with the instructions indicated. A proxy voted by telephone or the Internet and not revoked will be voted in accordance with the shareholder’s instructions. If no instructions are given, proxies that are signed and returned or voted by telephone or the Internet will be voted as follows:

“FOR” the election of the nominated directors for the ensuing year;

“FOR” the proposal to ratify the appointment of Grant Thornton LLP as the independent registered public accountants of GEO for the fiscal year 2018;2024;

“FOR” the advisory approval of the resolution on named executive officer compensation;

“FOR”FOR” the proposal to approveThe GEO Group, Inc.approve the Second Amended and Restated 2018 Stock Incentive Plan;

“FOR” the proposal to approve the Amended and Restated Articles of Incorporation to increase the number of authorized shares of our common stock from 187,500,000 to 225,000,000 shares; and

“AGAINST”AGAINST” the shareholder proposal regarding shareholder proxy access,a third-party racial equity audit and report, if properly presented before the meeting.

Under New York Stock Exchange rules, brokerage firms have authority to vote shares on routine matters for which their customers do not provide voting instructions. The ratification of the appointment of Grant Thornton LLP as our independent registered public accountants for 20182024 is considered a routine matter. The approval of the Amended and Restated Articles of Incorporation to increase the number of authorized shares of our common stock from 187,500,000 to 225,000,000 (the “Authorized Shares Amendment”) is also considered a routine matter. As a result, if you hold your shares through a broker and do not direct the broker how to vote your shares on thisthese routine matter,matters, your broker may vote the shares on your behalf.

Under New York Stock Exchange rules, the election of directors, the advisory vote to approve named executive officer compensation, the proposal to approve the Second Amended and Restated 2018 Stock Incentive Plan, and the shareholder proposal are not considered a routine matter.matters. As a result, if a brokerage firm does not receive voting instructions from the beneficial owner of shares held by the firm, those shares will not be voted and will be considered brokernon-votes with respect to those matters. A brokernon-vote will have no effect on the election of directors, the advisory vote to approve named executive officer compensation, the proposal to approve the Second Amended and Restated 2018 Stock Incentive Plan and the shareholder proposal.

This proxy statement, the notice of annual meeting, the proxy card and our 20172023 annual report will be mailed or made accessible via the Internet on or about March 13, 2018.22, 2024.

Management is not aware of any other matters to be presented for action by shareholders at the annual meeting.

Holders of GEO common stock at the close of business on February 27, 2018,March 11, 2024, the record date, will be entitled to one vote for each share of common stock outstanding in their name on the books of GEO at that date. On February 27, 2018,March 11, 2024, GEO had 123,646,068126,899,232 shares of common stock outstanding.

1

The presence, in person or by proxy, of at least a majority of the total number of shares of common stock outstanding on the record date will constitute a quorum for purposes of the annual meeting. The election of directors requires a majority of the votes cast. The appointment of Grant Thornton LLP will be ratified if the number of votes cast in favor of ratification exceeds the number of votes cast against ratification. The advisory vote to approve named executive officer compensation will be approved if the number of votes cast in favor of approval exceeds the number of votes cast against approval. The proposal to approve the Second Amended and Restated 2018 Stock Incentive Plan will be approved if the number of votes cast in favor of approval exceeds the number of votes cast against approval. The proposal to approve the Amended and Restated Articles of Incorporation to increase the number of authorized shares of our common stock from 187,500,000 to 225,000,000 shares requires the affirmative vote of a majority of the shares of common stock entitled to vote. The shareholder proposal will be approved if the number of votes cast in favor orof approval exceeds the number cast against approval. Shares of common stock represented by proxies that reflect abstentions or “brokernon-votes” (i.e., shares held by a broker or nominee which are represented at the annual meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum for the proposal but will not be counted as “votes cast” with respect to the election of directors, the advisory vote to approve named executive officer compensation, the proposal to approve the Second Amended and Restated 2018 Stock Incentive Plan and the shareholder proposal. Abstentions will have the same effect as an “against” vote on the Authorized Shares Amendment. As noted above, we believe that the Authorized Shares Amendment will be considered a “routine” matter and, as a result, we do not expect there to be any broker non-votes on the Authorized Shares Amendment. If, however, a broker non-vote occurs (or if your shares are not affirmatively voted in favor of the Authorized Shares Amendment for any other reason), it will have the same effect as an “against” vote on the Authorized Shares Amendment. If less than the majority of the outstanding shares of common stock are represented at the annual meeting, a majority of the shares so represented may adjourn the annual meeting to another date and time.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder

Meeting to be held on Tuesday, April 24, 2018.Friday, May 3, 2024 at 10:00 a.m. The Proxy Statement and

2017and 2023 Annual Report to Shareholders are available atwww.proxyvote.com. www.proxyvote.com.

| 1. | This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials before voting. |

| 2. | The proxy statement and annual report to security holders is available at www.proxyvote.com. |

| 3. | If you want to receive a paper ore-mail copy of these documents, you must request one. There is no charge to you for requesting a copy. Instructions on how to request a paper ore-mail copy can be found on the “Important Notice Regarding the Availability of Proxy Materials” (“Notice”). To request the documents by email, send a blank email with the |

Any person giving a proxy has the power to revoke it any time before it is voted by providing written notice to GEO addressed to the Corporate Secretary, by executing and delivering a later dated proxy, or by participating in the meeting and voting the shares electronically.

The costs of preparation, assembly and mailing this proxy statement and the accompanying materials will be borne by GEO. GEO will also pay the cost of soliciting your proxy and reimbursing brokerage firms and others for forwarding proxy materials to you. Certain of GEO’s officers, directors and employees may participate in the solicitation of proxies by mail, personal interview, letter, fax and telephone without additional consideration.

2

PROPOSAL 1:

ELECTION OF DIRECTORS

Director Nominees

GEO’s boardBoard of directorsDirectors is currently comprised of six (6)eight (8) members. Eight directors are nominated for election at our annual meeting, including seven independent directors and our Executive Chairman. All of the nominees are presently directors of GEO andGEO. All nominees were elected by the shareholders at GEO’s 20172023 annual meeting. Each director is elected to serve a one-year term, with all directors subject to annual election.

If instructed, the persons named on the accompanying proxy card will vote for the election of the nominees named below to serve for the ensuing year and until their successors are duly elected and qualified. If any nominee for director shall become unavailable (which management has no reason to believe will be the case), it is intended that the shares represented by the enclosed proxy card will be voted for any such replacement or substitute nominee as may be nominated by the boardBoard of directors.Directors.

| Director Nominees | Age | Since | Current Positions | |||

Clarence E. Anthony | 58 | 2010 | Director | |||

Anne N. Foreman | 70 | 2002 | Director | |||

Richard H. Glanton | 71 | 1998 | Director | |||

Christopher C. Wheeler | 71 | 2010 | Director | |||

Julie Myers Wood | 48 | 2014 | Director | |||

George C. Zoley | 68 | 1988 | Chairman and Chief Executive Officer |

| Director Nominees | Age | Since | Current Positions | |||

Thomas C. Bartzokis | 66 | 2022 | Director | |||

Jack Brewer | 45 | 2021 | Director | |||

Scott M. Kernan | 63 | 2018 | Director | |||

Lindsay L. Koren | 46 | 2022 | Director | |||

Terry Mayotte | 64 | 2021 | Director | |||

Andrew N. Shapiro | 64 | 2022 | Director | |||

Julie Myers Wood | 54 | 2014 | Director | |||

George C. Zoley | 74 | 1988 | Executive Chairman |

The following is a brief biographical statement for each director nominee:

Director Nominees

| Thomas C. Bartzokis — Dr. Bartzokis brings extensive experience in the medical field to the Board | |

3

|

Mr. Brewer brings business leadership and educational experience working with individuals in

|

|

Mr. |

|

Ms. Koren brings extensive legal, compliance, including international compliance, immigration and appellate litigation experience to the Board of Directors. Her experience as a member of the | |

4

| Terry Mayotte — Mr. Mayotte has served as a director of GEO since July 2021. Since December 2018, Mr. Mayotte has served as Strategic Advisor for PEO and Acquisitions, as well as President of Paychex Insurance Agency for Paychex, Inc. Prior to this role, Mr. Mayotte held the position of Executive Vice President and Chief Financial Officer at Oasis Outsourcing, where he founded the organization in 1996 and was a principal architect of the company’s business model and strategic direction overseeing its growth to become the largest privately held professional employer organization with over 225,000 co-employees prior to being sold in 2018 to Paychex, Inc. Prior to that, Mr. Mayotte held the role of Treasurer of The Wackenhut Corporation, where he supervised the company’s banking and cash operations, mergers and acquisitions and risk management. Mr. Mayotte also serves as a director on the board of Trean Insurance Group, Inc. Mr. Mayotte received a Bachelor of Arts degree in Business Administration from Emory University. Mr. Mayotte brings invaluable expertise creating insurance strategies and building financial systems and controls, technology platforms and negotiating key supplier relationships. His banking, cash operations, mergers and acquisitions and risk management experience will strengthen the Board of Directors’ collective knowledge, capabilities and experience. | |

| Andrew N. Shapiro — Mr. Shapiro has served as a director of GEO since February 2022. Mr. Shapiro has over thirty years of experience in the banking industry. Mr. Shapiro is the founder and Chief Executive Officer of Applied Risk Capital LLC, a company he launched in October of 2019 that is dedicated to indemnifying banks against the non-payment of loans and derivatives in the B to BB rating categories. Mr. Shapiro served in a variety of capacities at BNP Paribas from 1995 through August 2018, including as Head of Loan Capital Markets for the Americas from 2004 to 2011, Head of the Value Preservation Group (the bank’s loan and derivative restructuring group) for the Americas from 2009 to 2011, Global Head of Loan Syndications from 2011 to 2015, and Head of Corporate Debt Origination for the Americas from 2015 to August 2018. Mr. Shapiro received a Bachelor of Arts degree from the University of Rochester and a Master of Business Administration degree from New York University School of Business. Mr. Shapiro brings extensive banking and capital markets experience to the Board of Directors. His banking and capital markets experience will strengthen the Board of Directors’ collective knowledge, capabilities and experience. | |

5

| Julie Myers Wood — Ms. Wood has served as a director of GEO since 2014. She is currently the Chief Executive Officer of Guidepost Solutions LLC (“Guidepost”), a company specializing in monitoring, compliance, international investigations and risk management solutions, after joining the organization in 2012 as president of its Compliance, Federal Practice and Software Solutions division. government. Ms. Wood’s previous leadership positions in the federal government include Assistant Secretary for Export Enforcement at the Department of Commerce,

| |

Ms. Wood brings extensive federal government, legal and management experience to the |

| George C. Zoley —

As GEO’s founder, his knowledge, experience, and leadership are invaluable to the operation and development of the company. His more than | |

Recommendation of the Board of Directors

The boardBoard of directorsDirectors unanimously recommends a vote “FOR”“FOR” each of the sixeight nominees for director.

Director Emeritus

6

|

|

The executive officers of GEO as of February 27, 2018March 11, 2024 are as follows:

| Name | Age | Position | |||

George C. Zoley, Ph.D. | |||||

Brian R. Evans | |||||

Wayne Calabrese | 73 | President and Chief | |||

| 58 | Acting Chief Financial Officer, Executive Vice President, Finance and Treasurer | |||

James H. Black | 60 | Senior Vice President and President, | |||

| Senior Vice President, Legal Services, General Counsel and | ||||

| Senior Vice President, | ||||

| |||||

Richard K. Long | Senior Vice President, Project Development | ||||

Christopher D. Ryan | 61 | Senior Vice President, Human Resources | |||

Ronald A. Brack | Executive Vice President, Chief Accounting Officer and Controller | ||||

|

George C. Zoley — Please refer to the biographical information listed above in the “Director Nominees” section.

Brian R. Evans — Brian R. Evans joined GEO in 2000 and has over 20 years of business management experience. Since joining the company, Mr. Evans has served in increasingly senior business management positions including as Vice President of Finance, Chief Accounting Officer, and Controller, and was namedas GEO’s Senior Vice President and Chief Financial Officer in 2009.

Asfrom 2009 through 2023, and was named Chief FinancialExecutive Officer, Mr. Evans is responsible for the overall financial management of GEO and its subsidiaries and the Company’s acquisition and growth initiatives.effective January 1, 2024. Since joining the Company, Mr. Evans has overseen significant financial growth and shareholder value creation.

During his tenure at GEO, Mr. Evans has been instrumental in successfully executing the Company’s strategy for three secondary public offerings of equity; the execution of multiple financing transactions; and the successful completion of major business transactions including the acquisitions of Correctional Services Corporation in 2005, CentraCore Properties Trust in 2007, Cornell Companies in 2010, BI Incorporated in 2011, LCS Corrections in 2014 and Community Education Centers in 2017. Mr. Evans was also instrumental in GEO’s highly successful conversion to a Real Estate Investment Trust in 2013.

Prior to joining GEO, Mr. Evans worked for Arthur Andersen LLP as a Manager in the Audit and Business Advisory Services Group from 1994 until joining GEO. During his tenure at Arthur Andersen, Mr. Evans supervised the financial statement audits of both public and private companies and city and county governments. From 1990 until 1994, Mr. Evans served as an Officer in the Supply Corps of the United States Navy and was assigned to the USS Monterey in Jacksonville, Florida.

Mr. Evans graduated in 1990 from the University of Notre Dame with a Bachelor’s Degree in Accounting. Mr. Evans is a member of the American Institute of Certified Public Accountants.

J. David DonahueWayne Calabrese — J. David DonahueMr. Calabrese was appointed GEO’s President and Chief Operating Officer in January 2024 and previously served as GEO’s Senior Vice President and Chief Operating Officer from December 2022 through December 2023 and GEO’s Senior Vice President of Legal Services from September 2021 through December 2022. Mr. Calabrese brings extensive knowledge and experience to GEO’s management team. His experience, together with his prior service in various GEO leadership positions, makes him uniquely qualified to serve as GEO’s President and Chief Operating Officer. Mr. Calabrese had previously served as Vice Chairman of

7

the Board, President and Chief Operating Officer of GEO until his retirement in December 2010. Mr. Calabrese originally joined GEO as the Eastern Region Vice President of Business Development in 2009 after1989 and served in a distinguishedrange of increasingly senior positions. Prior to joining GEO, Mr. Calabrese was a partner in the Akron, Ohio law firm of Calabrese, Dobbins and Kepple. He also served as an Assistant City Law Director in Akron, Ohio; an Assistant County Prosecutor and Chief of the County Bureau of Support for Summit County, Ohio; and Legal Counsel and Director of Development for the Akron Metropolitan Housing Authority.

Mr. Calabrese received his bachelor’s degree in Secondary Education from the University of Akron and his Juris Doctor from the University of Akron Law School.

Shayn P. March — Mr. March joined GEO as Vice President of Finance and Treasurer in March 2009. Mr. March was named Acting Chief Financial Officer, effective January 1, 2024. As Acting Chief Financial Officer, Mr. March is responsible for the overall financial management of GEO and its subsidiaries and the Company’s acquisition, disposition and growth initiatives. Prior to joining GEO, Mr. March served as a Managing Director for the Corporate Investment Banking group at BNP Paribas, where he worked for eleven years in increasing capacities. From 1995 to 1997, Mr. March was employed at Sanwa Bank in the Corporate Finance Department. From 1988 to 1994, Mr. March was employed at UJB Financial in the Finance and Credit Audit Departments.

Mr. March earned his Masters in Business Administration in Financial Management from the Lubin School of Business at Pace University and his Bachelor of Arts in Economics at Rutgers University.

James H. Black — Mr. Black joined GEO in June 1998 as Senior Warden of a GEO correctional facility. Mr. Black has more than 37 years of experience in corrections and currently serves as the Senior Vice President and President of Secure Services. In this role, Mr. Black oversees approximately 79,000 beds and over 17,000 employees at 68 diverse facilities across the U.S., Australia, South Africa, and the United Kingdom. Mr. Black began his career in corrections in 1985 as a Correctional Officer with the StatesTexas Department of IndianaCriminal Justice (TDCJ). Over the next eight years, he rose through the ranks to the position of Senior Warden. After joining GEO, he served as Warden at several GEO-operated facilities in Texas and Kentucky as well asFlorida before accepting the Federal Bureauposition of Prisons.Assistant Director of Operations in GEO’s Central Region Office. In his previous role as2005, Mr. Black was promoted to Director of Compliance for the Eastern RegionalWestern Region. He later transferred to the position of Director of Operations before being named Vice President of the Western Region Office in 2009, where he was responsible for the operational oversight of 25 facilities and over 24 correctional facilities encompassing over 31,00015,000 beds. He was later named Vice President of GEO’s Central Region.

Mr. Donahue was promoted toBlack graduated from the Palestine Independent School District in 1981. Mr. Black is currently pursuing his Bachelor of Applied Science in Business Management at California Southern University.

Joe Negron — Mr. Negron joined GEO in December 2018, became Senior Vice President, General Counsel and Corporate Secretary effective January 2019 and became GEO’s Senior Vice President, GEO CorrectionsLegal Services, General Counsel and Detention in January 2016.

Corporate Secretary effective December 2022. Prior to joining GEO, Mr. DonahueNegron had 30 years of experience in business law and complex corporate and commercial litigation. Mr. Negron has worked for several prestigious Florida law firms throughout his career, most recently in the litigation practice at Akerman LLP. Mr. Negron also served in the Florida Legislature for fifteen years, including service as Commissionerboth House and Senate Appropriations Chair, as well as President of the Indiana DepartmentFlorida Senate in his final term.

Mr. Negron received his undergraduate degree from Stetson University, his Juris Doctor degree from Emory University School of Correction. As Commissioner, he ledLaw and a workforce of over 9,000 employees, supervising nearly 39,000 offendersMasters in addition to 3,000 Juvenile Offenders and those individuals placed on community supervision. During his tenure with Indiana,Public Administration from Harvard University.

Matthew T. Albence — Mr. Donahue worked diligently to instill best correctional practices. He employed his leadership skills to provide better protection to the public through an improvedsex-offender registry system, enhanced facility

security with the addition ofstate-of-the-art equipment and protocols, consolidated services to increase departmental efficiency and effectiveness, and prepared offenders for reentry using model case management practices.

Prior to leading the Indiana Department of Correction, Mr. Donahue servedAlbence joined GEO in 2022 as Deputy Commissioner for the Kentucky Department of Corrections. In this position, he provided administrative policy direction to all departmental divisions. He was responsible for the planning and supervision of duties for the Directors of the Division of Administrative Services, the Division of the Corrections Training, the Division of Correctional Industries, and the Branch Managers of Offender Information and Information and Technology.

Mr. Donahue began his corrections career as a Correctional Officer. During his correctional career he moved up the ranks serving in various positions including Case Worker, Unit Manager, Executive Assistant and Warden of several facilities in the country. Mr. Donahue now serves asSenior Vice President of the American Correctional Association (“ACA”) and is anACA-Certified Corrections Executive. In addition, he is an active member of the ACA and serves on the Restrictive HousingSub-Committee.Client Relations. Since September 2020, Mr. Donahue is also a member of the Association of State Correctional Administrators. He attended Eastern Kentucky University, where he earned his Bachelors of Science in Police Administration. He later attended Spalding University, where he completed coursework in the Masters of Arts in Teaching Graduate Program.

Ann M. Schlarb —Dr. Schlarb joined GEO in 2011 as Vice President of Intensive Supervision and Appearance Program (“ISAP”) Services as a result of GEO’s acquisition of B.I. Incorporated, (“B.I.”). Dr. Schlarb joined BI Incorporated in 1995 and was involved in the development, implementation, and operations of two different national programs, one providing supervision and treatment services to offenders in the Criminal Justice System, and the other overseeing field operations for the immigration services division of BI. Dr. Schlarb left BI briefly to complete her doctoral degree in 2009 in Organizational Psychology, during which she remained a consultant. Dr. Schlarb was named Divisional Vice President in May 2012 and managed the BI location monitoring and immigration services division within GEO Care. Promoted to Senior Vice President and President of GEO Care in July 2014, Dr. Schlarb is now responsible for the GEO Care division of GEO, which encompasses the ‘GEO Continuum of Care’ organization, intensive residential andnon-residential programming, youth services, electronic monitoring equipment and services, and community-based immigration services.

Dr. Schlarb began her Criminal Justice career in 1986 working as a detention and probation officer, and later as Assistant Director of Operations and Treatment for a Probation Violators facility in San Antonio, Texas. She earned her Master’s degree in Organizational Management and holds several criminal justice certifications.

John J. Bulfin — As GEO’s General Counsel and Secretary since 2000, Mr. Bulfin has oversight responsibility for all of GEO’s corporate governance, litigation, investigations, and professional responsibility.

Mr. Bulfin is a member of the Florida Bar and the American Bar Associations. He has been a trial lawyer since 1978 and is a Florida Bar Board Certified Civil trial lawyer. He has served on the Grievance Committee for the Fifteenth Judicial Circuit of Florida andAlbence has served as a memberPrincipal at GrindStone Strategic Consulting, LLC, a boutique consulting firm providing services in the area of the Board of Directors of the Leukemianational security, law enforcement, business development, and Lymphoma Society of Palm Beach.

management and leadership consulting. Prior to joining GEOthat, Mr. Albence had a 26-year career in 2000,federal law

8

enforcement. From May 2012 to August 2020, Mr. Bulfin wasAlbence served in a founding partnervariety of roles for U.S. Immigration and Customs Enforcement, culminating as the law firm Wiederhold, Moses, Bulfin & Rubin,Acting Director, where he led an organization of 20,000 professionals in West Palm Beach, Florida. Mr. Bulfin attended the University of Florida, received his bachelor’s degree cum laude from Regis College in Denver, Coloradoover 400 domestic and his juris doctor from Loyola University School of Law in Chicago, Illinois.

David J. Venturella — Mr. Venturella joined GEO in 2012 as Executive Vice President, Corporate Development. In 2014, he was promoted to Senior Vice President, Business Development. Mr. Venturella isinternational offices, responsible for leading GEO’s business and proposal development efforts.

Prior to joining GEO, Mr. Venturellathe enforcement of hundreds of federal statutes. He also served in various leadership positions including as theDeputy Director, Executive Associate Director for the Office of Enforcement and Removal Operations, for ICE from February 2011 to June 2012.

In addition to his22-year career with ICE, Mr. Venturella has worked in the private sector in business development and strategic planning. From May 2004 to September 2007, he served as Vice President of the Homeland Security Business Unit for USIS in Falls Church, Virginia, where he was credited with increasing annual revenues by an average of 15 percent during his tenure. He also served asAssistant Director of Business Development for USIS in the company’s Professional Services Division and served as Director of Business Development for the Global SecurityEnforcement and Engineering Services Unit withL-3 Communications in Chantilly, Virginia from September 2007 to May 2008. David Venturella has more than 26 years experience in federal law enforcement operations and business development. His expertise includes strategic planning, organizational management, project development and program execution.Removal Operations Enforcement Division.

Mr. Venturella hasAlbence holds a BachelorB.S. in Justice from American University and a M.S. in Administration of Science degree in Political ScienceJustice from Bradley University in Peoria, Illinois. He has also completed the Harvard/MIT Executive Leadership Course at Harvard University’s Kennedy School of Government.Southern Illinois University.

Richard K. Long — Mr. Long joined GEO in 2017 as Senior Vice President of Project Development after a distinguished career working for Balfour Beatty Construction for the last 30 years.

Mr. Long has developed extensive expertise with commercial and federal government construction as well as engineering projects using design-build and construction management at risk delivery methods for both public and private sector clients, with a combined construction value in excess of $5.0 billion. During his30-year career at Balfour Beatty Construction, Mr. Long held positions of Civil Engineer, Project Engineer, Chief Estimator, Assistant Project Manager, Vice President of Preconstruction, Senior Vice President of Business Acquisition, and Senior Vice President & South Florida Business Unit Leader responsible for leading Balfour Beatty’s $600 million annual South Florida business.

With 32over 30 years of construction experience, Mr. Long also finds time for industry service. He is a long-time member and past-chairman of Florida’s largest chapter of the Associated Builders and Contractors (“ABC”). Additionally, as founding member and past-president of the Society of American Military Engineers (“SAME”) South Florida chapter, Mr. Long accepted multiple accolades at the association’s 2012 National Joint Engineer Training Conference.

Mr. Long received his Bachelor of Science in Civil Engineering from the University of Missouri and a Bachelor of Science in Construction Management from the University of Louisiana-Monroe.

Christopher D. Ryan — Mr. Ryan joined GEO in 2011 and has over 30 years of human resources experience. Since joining the company, Mr. Ryan has served in increasingly senior human resources positions, including the Director of Employee and Labor Relations, Vice President of Employee and Labor Relations, Executive Vice President of Human Resources, and was subsequently promoted to Senior Vice President of Human Resources in 2023. Mr. Ryan also leads the Company’s diversity, equity, and inclusion (DEI) efforts. DEI remains a top business priority, given the fact that more diverse and inclusive companies tend to outperform other employers. Prior to joining The GEO Group, Mr. Ryan held numerous human resources leadership roles at American Airlines, Florida Power & Light and Southern Wine & Spirits of America. Mr. Ryan is also actively involved in the community and sits on the Board of Directors of several 501(c)(3) non-profit organizations serving youth and other residents of Palm Beach County, Florida.

Mr. Ryan holds a Bachelor’s of Science degree in Community Health Services from the State University of New York, Plattsburgh.

Ronald A. Brack — Mr. Brack assumed the role of Vice President, Chief Accounting Officer and Controller for the Company in August 2009. Mr. Brack was GEO’s Vice President and Controller from January 2008 to August 2009 and Controller from April 2007 to January 2008. Mr. Brack joined GEO in May 2005 as Assistant Controller. From 2000 until joining GEO, Mr. Brack was with Fort Lauderdale, Florida based NationsRent, Inc. where his most recent position was Assistant Controller. From 1997 to 2000, Mr. Brack was with the Fort Lauderdale office of Arthur Andersen, LLP where his most recent position was Senior Auditor in the Audit and Business Advisory Services Group. Prior to that time, Mr. Brack spent over ten years in the fleet management business with World Omni Leasing, Inc. and GE Capital Fleet Services.

Mr. Brack attended Florida Atlantic University and hasholds a bachelor’sBachelor’s of Arts degree in Economics from Vanderbilt University. He is a member of the American Institute of Certified Public Accountants.

Shayn P. March — Mr. March joined GEO as Vice President of Finance and Treasurer in March 2009. Prior to joining GEO, Mr. March served as a Managing Director for the Corporate Investment Banking group at BNP Paribas, where he worked for eleven years in increasing capacities. From 1995 to 1997, Mr. March was employed at Sanwa Bank in the Corporate Finance Department. From 1988 to 1994, Mr. March was employed at UJB Financial in the Finance and Credit Audit Departments. Mr. March earned his Masters in Business Administration in Financial Management from the Lubin School of Business at Pace University and his Bachelor of Arts in Economics at Rutgers University.

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the number of shares of GEO’s common stock that were beneficially owned at February 27, 2018March 11, 2024 (unless stated otherwise) by (i) each director and each nominee for election as director at the 20182024 annual meeting of shareholders, (ii) each named executive officer (“NEOs”) (as defined below), that is not a director, (iii) all directors, director nominees and executive officers as a group, and (iv) each person or group who was known by GEO to beneficially own more than 5% of GEO’s outstanding common stock.

| Name and Address of Beneficial Owner(1) | Amount & Nature of Beneficial Ownership(2) | Percent of Class(3) | ||||||

DIRECTOR NOMINEES(2) | ||||||||

Clarence E. Anthony | 46,408 | * | ||||||

Anne N. Foreman | 34.936 | * | ||||||

Richard H. Glanton | 15,489 | * | ||||||

Christopher C. Wheeler | 27,967 | * | ||||||

Julie Myers Wood | 17,625 | * | ||||||

George C. Zoley | 1,852,086 | 1.5 | % | |||||

NAMED EXECUTIVE OFFICERS(2) | ||||||||

John J. Bulfin | 257,679 | * | ||||||

Brian R. Evans | 152,362 | * | ||||||

J. David Donahue | 84,630 | * | ||||||

Thomas M. Wierdsma(4) | 114,065 | * | ||||||

ALL DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS AS A GROUP (14 Persons)(5) | 2,751,049 | 2.2 | % | |||||

OTHER | ||||||||

The Vanguard Group, Inc.(6) | 21,269,923 | 17.2 | % | |||||

Blackrock, Inc.(7) | 14,071,342 | 11.4 | % | |||||

Cohen & Steers, Inc.(8) | 11,733,525 | 9.5 | % | |||||

Barrow, Hanley, Mewhinney & Strauss, LLC(9) | 6,889,490 | 5.6 | % | |||||

| Name and Address of Beneficial Owner(1) | Amount & Nature of Beneficial Ownership(2) | Percent of Class(3) | ||||||

DIRECTOR AND DIRECTOR NOMINEES | ||||||||

Thomas C. Bartzokis | 43,412 | * | ||||||

Jack Brewer | 43,412 | * | ||||||

Scott M. Kernan | 66,124 | * | ||||||

Lindsay L. Koren | 26,050 | * | ||||||

Terry Mayotte | 43,412 | * | ||||||

Andrew Shapiro | 43,412 | * | ||||||

Julie Myers Wood | 88,550 | * | ||||||

George C. Zoley+ | 3,847,894 | 3.0 | % | |||||

NAMED EXECUTIVE OFFICERS | ||||||||

Jose Gordo | 438,980 | * | ||||||

Brian R. Evans | 726,768 | * | ||||||

Wayne Calabrese | 216,723 | * | ||||||

James Black | 188,689 | * | ||||||

ALL DIRECTORS, DIRECTOR NOMINEES AND EXECUTIVE OFFICERS AS A GROUP (17 Persons)(4) | 6,388,552 | 5.0 | % | |||||

OTHER | ||||||||

Blackrock, Inc.(5) | 19,752,429 | 15.6 | % | |||||

The Vanguard Group, Inc.(6) | 13,575,361 | 10.7 | % | |||||

| * | Less than 1% |

| + | Director and Named Executive Officer |

| (1) | Unless stated otherwise, the address of the beneficial owners is c/o The GEO Group, Inc., |

| (2) | Information concerning beneficial ownership was furnished by the persons named in the table or derived from |

| (3) | As of |

| (4) | Includes 2,557,379 shares of restricted stock that are unvested but have voting rights held by directors and executive officers (17 persons in total). 303,011 shares of common stock |

10

| (5) | The principal business address of BlackRock, Inc. is 50 Hudson Yards, New York, New York 10001. Based on Amendment No. 2 to Schedule 13G filed January 22, 2024, BlackRock reported that, as of December 31, 2023, it beneficially owned 19,752,429 shares |

| (6) | The principal business address of The Vanguard Group, Inc. (“Vanguard”) is 100 Vanguard Blvd., Malvern, |

|

|

|

THE BOARD OF DIRECTORS, ITS COMMITTEES AND OTHER CORPORATE GOVERNANCE INFORMATION

GEO’s boardBoard of directorsDirectors held nineseven meetings during fiscal year 2017.2023. Each director attended at least 75% of the total number of meetings of the boardBoard of directorsDirectors and of the meetings held by all board committees on which such director served.

Director Independence

Pursuant to the corporate governance standards applicable to companies listed on the New York Stock Exchange (“NYSE”), the boardBoard of directorsDirectors must be comprised of a majority of directors who qualify as independent directors. In determining independence, each year the boardBoard of directorsDirectors affirmatively determines whether directors have a “material relationship” with GEO. When assessing the “materiality” of a director’s relationship with GEO, the boardBoard of directorsDirectors considers all relevant facts and circumstances, not merely from the director’s standpoint, but also from that of the persons or organizations with which the director has an affiliation. An independent director is free from any relationship with GEO that may impair the director’s ability to make independent judgments. Particular attention is paid to whether the director is independent from management and, with respect to organizations affiliated with a director with which GEO does business, the frequency and regularity of the business conducted, and whether the business is carried out at arm’s length on substantially the same terms to GEO as those prevailing at the time from unrelated third parties for comparable business transactions. Material relationships can include commercial, banking, industrial, consulting, legal, accounting, charitable and familial relationships.

Applying the NYSE’s independence standards, the boardBoard of directorsDirectors has determined that, Clarence E. Anthony, AnneThomas C. Bartzokis, Jack Brewer, Scott M. Kernan, Lindsay L. Koren, Terry Mayotte, Andrew N. Foreman, Richard H. Glanton, Christopher C. WheelerShapiro and Julie Myers Wood qualify as independent under the NYSE’s corporate governance standards, and thatstandards. As a result, the boardBoard of directorsDirectors is therefore currently comprised and will continue to be comprised subsequent to the annual meeting of a majority of independent directors. The boardBoard of directors’Directors’ determination that each of these directors is independent was based on the fact that none of the directors had a material relationship with GEO outside of such person’s position as a director, including a relationship that would disqualify such director from being considered independent under the NYSE’s listing standards.

11

Committees

Under our corporate governance guidelines, the boardBoard of directorsDirectors has established eighttwelve standing committees. The members of the boardBoard of directorsDirectors serving on these committees and the functions of those committees are set forth below.

AUDIT AND FINANCE

Terry Mayotte, Chairman

|

Terry Mayotte, Chairman

Scott Kernan Andrew Shapiro | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Terry Mayotte, Chairman Scott Kernan Lindsay L. Koren Andrew Shapiro | ||

CRIMINAL JUSTICE AND REHABILITATION COMMITTEE Jack Brewer, Chairman Thomas C. Bartzokis Scott Kernan Lindsay L. Koren Julie Myers Wood | CYBER SECURITY AND ENVIRONMENTAL OVERSIGHT COMMITTEE Julie Myers Wood, Chairwoman Terry Mayotte Andrew Shapiro | EXECUTIVE COMMITTEE George C. Zoley, Chairman Terry Mayotte Andrew Shapiro | ||

HUMAN RIGHTS COMMITTEE Lindsay L. Koren, Chairwoman Jack Brewer Scott Kernan | INDEPENDENT COMMITTEE Terry Mayotte, Chairman Thomas C. Bartzokis Jack Brewer Scott Kerman Lindsay L. Koren Andrew Shapiro Julie Myers Wood | LEGAL STEERING COMMITTEE Lindsay L. Koren, Chairwoman Scott Kernan Julie Myers Wood | ||

Andrew Shapiro, Chairman

|

Julie Myers Wood | |||

|

OVERSIGHT COMMITTEE

Julie Myers Wood | |||

|

Thomas C. Bartzokis, Chairman

| |||

Audit and Finance Committee

The Audit and Finance Committee met fivetwelve times during fiscal year 2017.2023. The Report of the Audit and Finance Committee is included in this proxy statement.

All of the members of the Audit and Finance Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934 are independent (as independence is defined under Exchange Act Rule10A-3, as well as under Section 303A.02 of the NYSE’s listing standards). In addition, the boardBoard of directorsDirectors has determined that each of Mr. Glanton is theMayotte and Mr. Shapiro qualify as an “audit committee financial expert” as that term is defined under Item 407(d)(5) of RegulationS-K of the SEC’s rules.

The Audit and Finance Committee has a written charter adopted by the boardBoard of directors.Directors. It can be found on our website at http://www.geogroup.com by clicking on the link “Social Responsibility” on our homepage and then clicking on the links “Governance with Integrity-Corporate Governance.” In addition, the charter is available in

12

print to any shareholder who requests it by contacting our Executive Vice President of Corporate Relations at561-999-7306.561-893-0101. Pursuant to the charter, the main functions and responsibilities of the Audit and Finance Committee include the following:

select, in its sole discretion, our independent auditor and review and oversee its performance;

review and approve in advance the terms of our independent auditor’s annual engagement, including the proposed fees, as well as the scope of auditing services to be provided;

oversee the independence of the Company’s independent auditor;

| • | review and approve in advance any non-audit services to be provided by the independent auditor, including the proposed fees; |

review and approve in advance anynon-audit services to be provided by the independent auditor, including the proposed fees;

review with management, our internal auditor and our independent auditor, our significant financial risks or exposures and assess the steps management has taken to monitor and mitigate such risks or exposures;

review and discuss with management and our independent auditor the audit of our annual financial statements and our internal controls over financial reporting, and our disclosure and the independent auditor’s reports thereon;

meet privately with our independent auditor on any matters deemed significant by the independent auditor;

establish procedures for the submission, receipt, retention and treatment, on an anonymous basis, of complaints and concerns regarding our accounting, internal accounting controls or auditing matters;

establish, review periodically and update as necessary a Code of Business Conduct and Ethics (the “Code of Conduct”), ensure that management has established a system to enforce the Code of Conduct, and review management’s monitoring of the Company’s compliance with the Code of Conduct;

review with our counsel legal matters that may have a material impact on our financial statements, our compliance policies and any material reports or inquiries from regulators or government agencies; and

address or take action with respect to any other matter specifically delegated to it from time to time by the boardBoard of directors.Directors.

Compensation Committee

The Compensation Committee met sixnine times during fiscal year 2017.2023. The Report of the Compensation Committee is included in this proxy statement.

All of the members of the Compensation Committee are independent (as independence is defined under Section 303A.02 of the NYSE’s listing standards).

The Compensation Committee has a written charter adopted by the boardBoard of directors.Directors. It can be found on our website at http://www.geogroup.com by clicking on the link “Social Responsibility” on our homepage and then clicking on the links “Governance with Integrity-Corporate Governance.” In addition, the charter is available in print to any shareholder who requests it by contacting our Executive Vice President of Corporate Relations at561-999-7306.561-893-0101. Pursuant to the charter, the main functions and responsibilities of the Compensation Committee include the following:

review on a periodic basis and, if appropriate, make recommendations with respect to director compensation;

establish our executive compensation philosophy, and review and approve the compensation of all of our corporate officers, including salaries, bonuses, stock option grants and other forms of compensation;

review the general compensation structure for our corporate and key field employees;

13

establish annual and long-term performance goals for the compensation of our Chief Executive Officer (“CEO”) and other senior executive officers, evaluate the CEO’s and such other senior executive officers’ performance in light of those goals, and, either as a committee or together with the other independent members of the boardBoard of directors,Directors, determine and approve the CEO’s and such other senior executives’ compensation level based on this evaluation;

review our program for succession and management development;

review our incentive-based compensation and equity-based plans and make recommendations to the boardBoard of directorsDirectors with respect thereto;

review and discuss with management our disclosures under “Compensation Discussion and& Analysis”, or CD&A, and based on such review and discussion make a recommendation to the Board as to whether the CD&A should be included in our proxy statement; and

address or take action with respect to any other matter specifically delegated to it from time to time by the boardBoard of directors.Directors.

For further information on the Compensation Committee’s processes and procedures for consideration and determination of executive compensation, see “Compensation Discussion and& Analysis” elsewhere in this proxy statement.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee met fivefour times during fiscal year 2017.2023.

All of the members of the Nominating and Corporate Governance Committee are independent (as independence is defined under Section 303A.02 of the NYSE’s listing standards).

The Nominating and Corporate Governance Committee has a written charter adopted by the boardBoard of directors.Directors. It can be found on our website at http://www.geogroup.com by clicking on the link “Social Responsibility” on our homepage and then clicking on the links “Governance with Integrity-Corporate Governance.” In addition, the charter is available in print to any shareholder who requests it by contacting our Executive Vice President of Corporate Relations at561-999-7306.561-893-0101. Pursuant to the charter, the main functions and responsibilities of the Nominating and Corporate Governance Committee include the following:

identify candidates qualified to become members of the boardBoard of directorsDirectors and select or recommend that the full boardBoard of directorsDirectors select such candidates for nomination and/or appointment to the boardBoard of directors;Directors;

review candidates for the boardBoard of directorsDirectors recommended by shareholders;

assist the Board in determining and monitoring whether or not each director and prospective director is an “independent director” within the meaning of any rules and laws applicable to GEO;

after consultation with the Executive Chairman and CEO, recommend to the boardBoard of directorsDirectors for approval all assignments of committee members, including designations of the chairs of the committees;

establish the evaluation criteria for the annual self-evaluation by the boardBoard of directors,Directors, including the criteria for determining whether the boardBoard of directorsDirectors and its committees are functioning effectively, and implement the process for annual evaluations;

develop, adopt, review annually and, if appropriate, update, corporate governance guidelines for GEO and evaluate compliance with such guidelines;

periodically review our Code of Conduct for directors, officers and employees, and approve amendments to the Code of Conduct to the extent deemed appropriate by the committee;

14

advise the boardBoard of directorsDirectors with regard to our policies and procedures for the review, approval or ratification of any transaction presenting a potential conflict of interest between us and any member of our boardBoard of directorsDirectors or any executive officers;

consider other corporate governance issues that arise from time to time, and advise the boardBoard of directorsDirectors with respect to such issues; and

address or take action with respect to any other matter specifically delegated to it from time to time by the boardBoard of directors.Directors.

In fulfilling the committee’s duties to identify and recommend candidates for election to our boardBoard of directors,Directors, the Nominating and Corporate Governance Committee considers the mix of skills, experience, character, commitment, and diversity — diversity being broadly construed to mean a variety of opinions, perspectives and backgrounds, such as gender, race and ethnicity differences, as well as other differentiating characteristics, all in the context of the requirements of our boardBoard of directorsDirectors at the time of election.

Criminal Justice and Rehabilitation Committee

The Criminal Justice and Rehabilitation Committee guides and oversees the Company’s efforts regarding rehabilitation and anti-recidivism.

Cyber Security and Environmental Oversight Committee

The Cyber Security and Environmental Oversight Committee guides and oversees the Company’s efforts regarding cybersecurity, privacy and environmental sustainability concerns.

Executive Committee

Periodically during fiscal year 2017,2023, members of the Executive Committee informally discussed various matters relating to GEO’s business. The Executive Committee has full authority to exercise all the powers of the boardBoard of directorsDirectors between meetings of the boardBoard of directors,Directors, except as reserved by the boardBoard of directors. During 2017, the Executive Committee acted four times through resolutions adopted at duly convened meetings or by unanimous written consent.Directors. All actions taken by the Executive Committee in 20172023 were ratified by the boardBoard of directorsDirectors at their next quarterly meeting.

Human Rights Committee

The Human Rights Committee guides and oversees the Company’s efforts regarding the protection of human rights.

Independent Committee

The Independent Committee considers matters that may arise from time to time that the Board of Directors designates for independent director review.

Legal Steering Committee

The Legal Steering Committee reviews with management strategic issues with respect to material litigation and other discrete legal issues.

Corporate Planning Committee

The Corporate Planning Committee periodically reviews with management various corporate strategic initiatives, including potential merger and acquisition activities, business expansion issues and corporate finance matters.

Operations and Oversight Committee

The Operations and Oversight Committee reviews with management various issues relating to our operations that may arise from time to time.

Legal Steering

15

Health Services Committee

The Legal SteeringHealth Services Committee reviews with management strategic issues with respect to material litigationguides and other discrete legal issues.oversees the Company’s operations in the area of health services.

Independent Committee

The Independent Committee considers matters that may arise from time to time that the board of directors designates for independent director review.

Director Identification and Selection

The processes for director selection and director qualifications are set forth in Section 3 of our Corporate Governance Guidelines. The boardBoard of directors,Directors, acting on the recommendation of the Nominating and Corporate Governance Committee, will nominate a slate of director candidates for election at each annual meeting of shareholders and will elect directors to fill vacancies, including vacancies created as a result of any increase in the size of the board,Board, between annual meetings. Nominees for director are selected on the basis of outstanding achievement in their personal careers, broad experience, wisdom, integrity, ability to make independent, analytical inquiries, understanding of the business environment, and willingness to devote adequate time to the duties of the boardBoard of directors.Directors. The boardBoard believes that each director should have a basic understanding of (i) the principal operational and financial objectives and plans and strategies of GEO, (ii) the results of operations and financial condition of GEO and of any significant subsidiaries or business segments, and (iii) the relative standing of GEO and its business segments in relation to its competitors. The boardBoard is committed to diversified membership and it does not and will not discriminate on the basis of race, color, national origin, gender, religion or disability in selecting nominees. The Nominating and Corporate Governance Committee may, to the extent it deems appropriate, engage a third party professional search firm to identify and review new director candidates and their credentials.

The Nominating and Corporate Governance Committee will consider proposed nominees whose names are submitted to it by shareholders. We adopted proxy access in advance of our 2017 annual meeting of shareholders.

Our proxy access provisions are set forth in Article II, Section 6 of our SecondThird Amended and Restated Bylaws (“Bylaws”). The proxy access provisions permit a shareholder, or a group of up to twenty (20) shareholders, owning three percent (3%) or more of the Company’s outstanding common stock continuously for at least three (3) years, to nominate twenty percent (20%) of the number of directors then in office (rounding down to the nearest whole number) provided that the shareholder or group and each nominee satisfy the eligibility, procedural and disclosure requirements for proxy access as specified in the Bylaws, including that the Company receive notice of such nominations between 90 and 120 days prior to the anniversary date of the previous year’s annual meeting of shareholders. Since our annual meeting for 20182024 is scheduled for April 24, 2018,May 3, 2024, any nomination pursuant to our proxy access process to be considered at the 20192025 annual meeting must be properly submitted to us not earlier than December 25, 2018January 3, 2025 or later than January 24, 2019.February 2, 2025.

In addition to satisfying the requirements under our Bylaws, to comply with the universal proxy rules, a person who intends to solicit proxies in support of director nominees other than the Company’s nominees must provide notice to the Company that sets forth the information required by Rule 14a-19(b) under the Exchange Act, including a statement that such person intends to solicit the holders of shares representing at least 67% of the voting power of the Company’s shares entitled to vote in the election of directors in support of director nominees other than the Company’s nominees.

There are no other differences between the considerations and qualifications for director nominees that are recommended by shareholders and director nominees recommended by the Nominating and Corporate Governance Committee. Other than adopting proxy access, the Nominating and Corporate Governance Committee has not adopted a formal process because it believes that the informal consideration process has been adequate to date. The Nominating and Corporate Governance Committee intends to review periodically whether a more formal policy should be adopted. If a shareholder wishes to suggest a proposed name of a nominee for consideration by the Nominating and Corporate Governance Committee outside of the proxy access process, the name of that nominee and related personal information should be forwarded to the Nominating and Corporate Governance Committee, in care of the Corporate Secretary, at least six months before the next annual meeting to assure time for meaningful consideration by the committee.

16

Board Leadership Structure

Our CEO alsoThe roles of Chief Executive Officer and Chairman are held by two separate individuals. George C. Zoley serves as theour Executive Chairman of the board of directors. Richard H. Glanton has servedand Brian R. Evans serves as Lead Independent Director of the Company since January 1, 2011.

Mr. Glanton has been a director of GEO since 1998 and is currently the Chairman of the Audit and Finance Committee, the Compensation Committee and the Independent Committee and a member of theour Chief Executive Committee, the Nominating and Corporate Governance Committee, the Operations and Oversight Committee and the Legal Steering Committee. As the Lead Independent Director, Mr. Glanton has input to the Chairman of the board on preparation of agendas for board and committee meetings. Mr. Glanton chairs board meetings when the Chairman of the board is not in attendance and provides input to the independent directors and ensures that the effectiveness of the board is assessed on a regular basis. The Lead Independent Director reports to the board regarding deliberations of the independent directors and may recommend special meetings of the independent directors as necessary. Because of Mr. Glanton’s long history as a board member and his service as the Chairman of the Audit and Finance Committee, the Compensation Committee and the Independent Committee, the board believes that Mr. Glanton is uniquely qualified to serve as the Lead Independent Director of the Company. In 2012, in connection with our conversion to a REIT, Mr. Glanton was the chairman of a special committee created to review and manage the divestiture of GEO Care, Inc.Officer.

As a company that is focused on its core business, we believe the CEOExecutive Chairman is in the best position to direct the independent directors’ attention on the issues of greatest importance to the Company and its shareholders. Since our CEOExecutive Chairman knows the Company’s business, is a pioneer in the industry and has over thirtyforty years of experience, we believe that our CEOExecutive Chairman is the appropriate person to lead the boardBoard of directors.Directors.

We are committed to independent Board oversight. Alongside our executive chairman, our Board leadership structure includes a lead independent director. Our overall corporate governance policies and practices combinedBoard has appointed Terry Mayotte to serve as lead independent director. Our lead independent director is responsible for, among other duties, coordinating with the strengthExecutive Chairman with respect to meeting agendas, and calling and chairing sessions of ourthe independent directors, including our Lead Independent Director, and our internal controls minimize any potential conflicts that may result from combining the roles of Chairman and CEO.directors.

We believe the current leadership structure of the boardBoard of directorsDirectors supports the risk oversight functions described below by providing independent leadership at the boardBoard and committee level through the Lead

Independent Director with ultimate oversight by the full boardBoard of directorsDirectors led by our Executive Chairman and CEO.lead independent director. The boardBoard of directorsDirectors periodically reviews and considers whether the current boardBoard leadership structure continues to be appropriate for our Company.

Board Risk Oversight

Our boardBoard of directorsDirectors has overall responsibility for risk oversight with a focus on the most significant risks facing the Company. Throughout the year, the boardBoard of directorsDirectors and the committees to which it has delegated responsibility dedicate a portion of their meetings to review and discuss specific risk topics in greater detail. The boardBoard of directorsDirectors has delegated responsibility for the oversight of specific risks to the following committees:

The Audit and Finance Committee oversees GEO’s risk policies and processes relating to the financial statements, financial reporting processes and credit risks.

The Operations and Oversight Committee oversees GEO’s operating risks. The Operations and Oversight Committee meets regularly during the year and on occasions when an operations incident occurs. The Operations and Oversight Committee may travel to the appropriate site to audit the operating practices and procedures if an incident has occurred.

The Compensation Committee oversees risks related to the Company’s compensation policies and practices.

The Legal Steering Committee oversees risks related to major litigation.

The Cyber Security and Environmental Oversight Committee guides and oversees the Company’s efforts and risks regarding cybersecurity, privacy and environmental sustainability concerns.

The Human Rights Committee guides and oversees the Company’s efforts and risks regarding the protection of human rights.

The Health Services Committee guides and oversees the Company’s efforts and risks related to health services.

Code of Business Conduct and Ethics

The boardBoard of directorsDirectors has adopted a code of business conduct and ethics applicable to GEO’s directors, officers, employees, agents and representatives, including its consultants, which we refer to as the Code of Conduct. The

17

Code of Conduct strives to deter wrongdoing and promote honest and ethical conduct, the avoidance of conflicts of interest, full, fair, accurate, timely and transparent disclosure, compliance with the applicable government and self-regulatory organization laws, rules and regulations, prompt internal reporting of violations of the Code of Conduct, and accountability for compliance with the Code of Conduct. The Code of Conduct can be found on our website at http://www.geogroup.com by clicking on the link “Social Responsibility” on our homepage and then clicking on the linkslink “Governance with Integrity- BusinessIntegrity-Business Conduct & Ethics.” In addition, the Code of Conduct is available in print to any shareholder who requests it by contacting our Executive Vice President of Corporate Relations at561-999-7306.561-893-0101.

Code of Ethics for CEO, Senior Financial Officers and Other Employees

Pursuant to Section 406 of the Sarbanes-Oxley Act of 2002, the boardBoard of directorsDirectors has also adopted a code of ethics for the CEO, its senior financial officers and all other employees, which we refer to as the Code of Ethics for Senior Financial Officers. The text of this Code of Ethics for Senior Financial Officers is located in Section 19 of GEO’s Code of Conduct. The Code of Ethics for Senior Financial Officers can be found on our website at http:// www.geogroup.com by clicking on the link “Social Responsibility” on our homepage and then clicking on the linkslink “Governance with Integrity-Business Conduct & Ethics.” In addition, the Code of Ethics for Senior Financial Officers is available in print to any shareholder who requests it by contacting our Executive Vice President of Corporate Relations at561-999-7306.561-893-0101.

Corporate Governance Guidelines

The boardBoard of directorsDirectors has adopted corporate governance guidelines to promote the effective functioning of the boardBoard of directorsDirectors and its committees, and the continued implementation of good corporate governance practices. The corporate governance guidelines address matters such as the role and structure of the boardBoard of directors,Directors, the selection, qualifications and continuing education of members of the boardBoard of directors, boardDirectors, Board meetings,non-employee director executive sessions, board self-evaluation, boardBoard committees, CEO performance review, succession planning,non-employee director compensation, certain shareholder matters and certain shareholder rights.

The corporate governance guidelines can be found on our website at http://www.geogroup.com by clicking on the link “Social Responsibility” on our homepage and then clicking on the linkslink “Governance with Integrity-Corporate Governance.” In addition, the corporate governance guidelines are available in print to any shareholder who requests them by contacting our Executive Vice President of Corporate Relations at561-999-7306.561-893-0101.

Annual Board and Committee Self-Assessments andNon-Employee Director Executive Sessions

The boardBoard of directorsDirectors conducts a self-assessment annually, which is reported by the Nominating and Corporate Governance Committee to the boardBoard of directors.Directors. In addition, the Audit and Finance Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee and the Cyber Security and Environmental Oversight Committee also undergo annual self-assessments of their performance. Thenon-employee directors of the boardBoard of directorsDirectors meet in executive session at least twice per year and such meetings are presided over by a presiding director who is typically the chairman of the Nominating and Corporate Governance Committee, who is currently Ms. Foreman.Lead Independent Director.

Communications with Directors

The boardBoard of directorsDirectors has adopted a process to facilitate written communications by shareholders or other interested parties to the entire board,Board, the independent members of the board as a group or any individual member of the board,Board, including the presiding directorLead Independent Director fornon-employee director executive sessions. Persons wishing to write to the boardBoard of directorsDirectors of GEO, or to a specified director (including the presiding director fornon-employee director executive sessions) or a committee of the board,Board, should send correspondence to the Corporate Secretary at 621 NW 53rd Street, Suite 700,4955 Technology Way, Boca Raton, Florida 33487.33431.

The Corporate Secretary will forward to the directors all communications that, in his or her judgment, are appropriate for consideration by the directors. Examples of communications that would not be appropriate for

18

consideration by the directors include commercial solicitations and matters not relevant to the shareholders, to the functioning of the board, or to the affairs of GEO.

Board Member Attendance at Annual Meetings

GEO encourages all of its directors to attend the annual meeting of shareholders. We generally hold a board meeting coincident with our annual meeting to minimize director travel obligations and facilitate their attendance at the annual meeting of shareholders. All of our directors at the time attended the 20172023 annual meeting of shareholders.

AdoptionEngagement with Shareholders

Over the past 12 months, members of GEO’s Senior Management and Board of Directors have had ongoing, substantive discussions with shareholders of GEO’s common stock. Over this timeframe, GEO has engaged with approximately 20 institutional shareholders, who are estimated to hold more than 50% of GEO’s outstanding shares of common stock. In addition, GEO has had ongoing discussions with retail investors, including members of the Interfaith Center on Corporate Responsibility. Specifically, as it relates to direct Board engagement with shareholders, GEO’s Lead Independent Director has held multiple discussions with GEO’s top four institutional shareholders.

In the course of these substantive discussions, GEO has been able to receive valuable feedback and diverse perspectives from a broad group of shareholders on a wide range of important matters: GEO’s Executive Compensation Plan, GEO’s Executive Management Transition, Board Composition and Oversight, and Environmental, Social and Governance matters, including Human Rights and Diversity, Equity and Inclusion.

As a direct result of GEO’s substantive engagement with shareholders, the Company has taken several proactive steps to address the valuable feedback received from shareholders.

Say on Pay

During discussions with shareholders regarding GEO’s Executive Compensation Plan, the predominant feedback the Company received centered around two matters: 1. GEO’s Executive Transition and specifically providing certainty of length and completion of the Company’s Senior Management transition and long-term roles of key company executives; and 2. the target metric used for GEO’s Annual Cash Incentive Compensation under the Company’s Senior Management Performance Award Plan, as amended (the “Performance Award Plan”). As a result of the feedback from shareholders, GEO has taken the following actions.

Executive Transition

As approved by the Board of Directors, on January 1, 2024, Brian Evans assumed the position of Chief Executive Officer (CEO); Wayne Calabrese assumed the position of President and Chief Operating Officer (COO); and Shayn March assumed the position of Acting Chief Financial Officer (CFO). Brian Evans has more than 20 years of experience in senior roles at GEO and previously served as the Company’s CFO since 2009. Wayne Calabrese previously held the position of President and COO for many years until his retirement in December 2010, and he rejoined the company in 2021 as the head of Legal Services before stepping into the COO role in December of 2022.

In addition to the Senior Management changes, GEO also announced in December 2023 that the Company’s Founder and current Executive Chairman, Dr. George Zoley, will transition to an advisory role and to the position of non-executive Chairman of the Board, subject to shareholder approval, when his current employment agreement expires in July 2026.

These actions provide for certainty with respect to GEO’s Executive Transition timeline and with respect to the future involvement of Dr. Zoley, who remains an integral part of GEO’s strategic planning and execution.

19

Target Metrics for Annual Cash Incentive Compensation

In August of 2023, the Compensation Committee approved replacing the net income metric under the Performance Award Plan with the Adjusted EBITDA metric effective for the 2023 fiscal year in order to align our compensation practices more closely with those of our peers. Specifically, EBITDA is the most common profitability metric, particularly among peer companies with higher leverage levels. Additionally, several shareholders had indicated to us through our ongoing shareholder engagement efforts that they would prefer that we use EBITDA as a metric instead of net income.

Being mindful of making this change to the metrics mid-year, the Compensation Committee determined to set the Adjusted EBITDA target based on the same earnings level that it had previously established earlier in the year for net income. In determining the amount of annual incentive cash compensation to be awarded to our named executive officers, our Adjusted EBITDA is weighted 65% and our revenue is weighted 35% (which are the same percentage weights previously assigned to the net income and revenue metrics).

Board Composition and Oversight